Fascination About Pacific Prime

Fascination About Pacific Prime

Blog Article

Pacific Prime - The Facts

Table of ContentsThe Facts About Pacific Prime UncoveredA Biased View of Pacific PrimeThe Basic Principles Of Pacific Prime Pacific Prime Fundamentals ExplainedThe 10-Minute Rule for Pacific Prime

Insurance coverage is a contract, stood for by a plan, in which a policyholder obtains economic protection or reimbursement against losses from an insurance business. The business pools customers' risks to pay a lot more budget friendly for the guaranteed. Many people have some insurance: for their cars and truck, their house, their healthcare, or their life.Insurance likewise assists cover prices connected with responsibility (lawful obligation) for damages or injury caused to a 3rd party. Insurance is an agreement (policy) in which an insurer indemnifies an additional versus losses from details contingencies or risks. There are numerous kinds of insurance policy policies. Life, wellness, house owners, and car are among the most usual types of insurance coverage.

Investopedia/ Daniel Fishel Numerous insurance coverage types are readily available, and virtually any type of private or company can find an insurance coverage business ready to guarantee themfor a price. Typical personal insurance plan types are vehicle, wellness, property owners, and life insurance policy. The majority of individuals in the United States have at least one of these kinds of insurance coverage, and automobile insurance is called for by state law.

The Basic Principles Of Pacific Prime

So finding the rate that is best for you calls for some legwork. The policy restriction is the maximum amount an insurer will pay for a covered loss under a policy. Maximums may be set per period (e.g., annual or plan term), per loss or injury, or over the life of the policy, likewise referred to as the life time optimum.

There are many various kinds of insurance policy. Health insurance policy assists covers routine and emergency medical treatment expenses, often with the alternative to include vision and oral solutions individually.

Many preventive solutions may be covered for totally free prior to these are met. Medical insurance might be bought from an insurance policy company, an insurance representative, the government Wellness Insurance coverage Industry, provided by an employer, or government Medicare and Medicaid insurance coverage. The federal government no longer calls for Americans to have health insurance coverage, yet in some states, such as The golden state, you might pay a tax charge if you do not have insurance.

Not known Factual Statements About Pacific Prime

The business after that pays all or many of the covered expenses linked with a car accident or various other automobile damages. If you have a rented lorry or borrowed cash to acquire an automobile, your loan provider or renting car dealership will likely need you to lug vehicle insurance coverage.

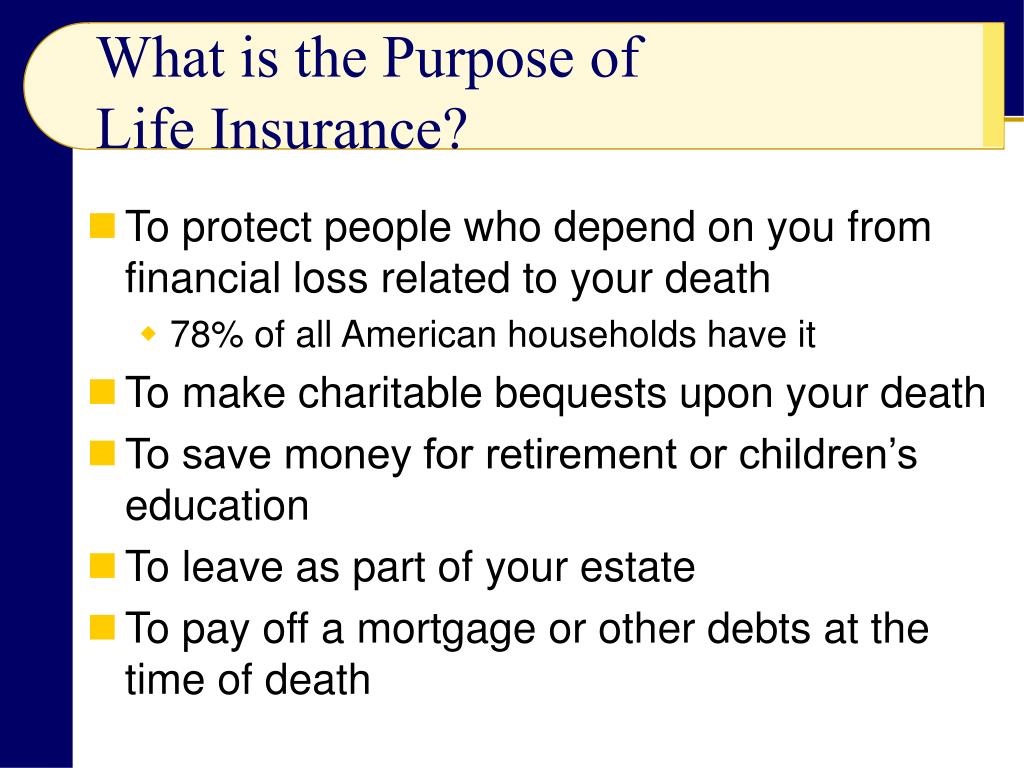

A life insurance policy policy assurances that the insurance company pays a sum of cash to your beneficiaries (such as a spouse or youngsters) if you pass away. In exchange, you pay costs throughout your lifetime. There are two main types of life insurance policy. Term life insurance coverage covers you for a details duration, such as 10 to two decades.

Irreversible life insurance policy covers your entire life as long as you continue paying the costs. Travel insurance coverage covers the expenses and losses connected with traveling, including trip terminations or hold-ups, coverage for emergency situation healthcare, injuries and evacuations, harmed baggage, rental autos, and rental homes. Nonetheless, also several of the best travel insurance provider - https://hub.docker.com/u/pacificpr1me do not cover cancellations or hold-ups because of weather, terrorism, or a pandemic. Insurance is a means to manage your financial dangers. When you buy insurance, you buy protection against unanticipated financial losses.

The Buzz on Pacific Prime

There are lots of insurance coverage policy kinds, some of the most typical are life, health, property owners, and auto. The best type of insurance policy for you will depend upon your goals and monetary circumstance.

Have you ever before had a minute while looking at your insurance policy or buying insurance when you've thought, "What is insurance policy? And do I Get More Information really require it?" You're not alone. Insurance can be a strange and confusing point. How does insurance policy work? What are the benefits of insurance coverage? And just how do you find the most effective insurance coverage for you? These prevail inquiries, and luckily, there are some easy-to-understand solutions for them.

Nobody desires something negative to happen to them. Yet experiencing a loss without insurance coverage can place you in a hard monetary circumstance. Insurance policy is a crucial financial tool. It can help you live life with fewer fears knowing you'll obtain financial aid after a disaster or accident, aiding you recoup much faster.

What Does Pacific Prime Mean?

And in many cases, like car insurance coverage and employees' payment, you might be required by regulation to have insurance in order to shield others - group insurance plans. Discover ourInsurance options Insurance is essentially a gigantic stormy day fund shared by many individuals (called insurance policy holders) and managed by an insurance coverage copyright. The insurance provider uses cash gathered (called costs) from its insurance policy holders and other investments to pay for its procedures and to satisfy its guarantee to insurance policy holders when they sue

Report this page